A bird's eye view on Africa

Regions, Economies, Industries

Hi everyone,

outside of the continent, Africa is often mistakenly spoken of as if it were a single, uniform entity.

However, with more than a 1000 languages spoken, over 50 countries and diverse geographic landscapes this couldn’t be further from the truth.

Today - taking a bird’s eye view - we’re diving deeper into the varied regions, economic hubs, and industries that make up this multifaceted continent.

Let’s go.

🕐 In a Hurry? Here's a 1-Minute Summary:

Regions: Africa's 1.3 billion population speaks to its diversity and economic potential. Africa's five primary regions - North, West, East, Central, and South Africa - each have distinct economic characteristics from petroleum-rich countries, to an agriculture of growing tech sector focus.

Economic Powerhouses: Nigeria and South Africa remain the largest economies in Sub-Saharan Africa, with a growing focus on technology and startups. In 2023, Nigeria has struggled facing significant challenges with its currency, the Naira (inflation of 30%, devaluation vs. the USD of over 50%). Smaller markets like Ivory Coast and Ethiopia are growing rapidly.

Main Industries: The continent's economy is predominantly driven by commodities, with a shift towards industry and services. Agriculture contributes around 20% of GDP, but is highly prominent as it provides around 60% of employment on the continent.

Renewable Energy Sector: Africa's potential in supplying green hydrogen to global markets presents a burgeoning opportunity in the sustainable energy market. Foreign investors are surging ties investing in large-scale pilot projects e.g., in Namibia. The infrastructure for transport remains a challenge.

Strategic Considerations for Investors: Understanding the unique economic and political landscapes of each region is crucial for successful investments in Africa's diverse markets.

⏳ Ready for a Deeper Dive? Here's the Breakdown:

Africa, with its population of 1.3 billion, is a continent of immense scale and diversity.

It's so vast that it can encompass the United States, China, India, Mexico, Japan and many European countries within its borders.

This expansive continent is home to a rich diversity of cultures, with 1000 to 2000 languages spoken across 3000 tribes in 54 countries.

Diverse Regions

Africa is divided into five primary regions: North, West, East, Central, and South Africa.

North Africa’s economy is predominantly driven by oil and natural gas, especially in Algeria and Libya. Egypt's economy is more diversified, with substantial agriculture, tourism, and an increasing focus on technology and manufacturing.

West Africa’s Economy is characterized by a mix of petroleum-rich countries like Nigeria and nations with economies based on agriculture and mining. The region also includes significant gold producers, like Ghana, and cocoa production is crucial for countries like Ivory Coast.

In East Africa’s Economy agriculture is a significant contributor, with countries like Ethiopia and Kenya leading in products like coffee and tea. The region is also witnessing a surge in technology and service sectors, with Kenya as a notable hub for fintech. Tourism, particularly in Kenya and Tanzania, plays a vital role, driven by rich wildlife and coastal attractions.

Central Africa’s Economy is dominated by the extraction and export of natural resources, particularly oil in countries like Angola and Gabon, and minerals in the DRC. The region's rainforest also supports timber production.

In Southern Africa’s economy, South Africa, the regional powerhouse, has a highly diversified economy including manufacturing, services, and mining. Countries like Botswana and Namibia are significant diamond producers, while Zambia is known for copper. The region has well-developed financial markets, particularly in South Africa.

Economic powerhouses

Sub-Saharan Africa’s GDP in 2023 was around 3 trillion. The continent's GDP is on a trajectory to reach more than $30 trillion by 2050.

The 10 largest economies make up for approximately 70% of the continent’s total economic output - dominated by the 3 giants Egypt, Nigeria and South Africa.

Those hubs are also where most venture capital is flowing into innovation: Cairo (Egypt), Lagos (Nigeria), Cape Town (South Africa), and Nairobi (Kenya) are the top tech and start-up ecosystem clusters in Africa.

However, in Sub-Saharan Africa, Nigeria and South Africa have been struggling, lagging behind in growth.

It’s rather smaller economies like Ivory Coast, DRC and Ethiopia that are expected to grow strongly at above 6% in 2024.

💡 Spotlight: Nigeria and South Africa compete for title of Sub-Saharan Africa's biggest economy

The IMF forecasts that South Africa will temporarily surpass Nigeria to become Sub-Saharan Africa's largest economy in 2024, with a GDP of $401 billion (for comparison, that is around 10% of Germany’s GDP).

Nigeria's economy has been larger than South Africa's for a few years. The year 2023, however, presented significant challenges for Nigeria's economy, particularly regarding its currency, the Naira.

The decision by President Bola Tinubu to remove foreign currency controls in June led to a substantial depreciation of the Naira against the US dollar (Year-on-Year over 50%!), and contributed to a near 30% annual inflation rate.

A critical factor in this economic landscape has been the scarcity of foreign USD reserves, driven by a decline in investment and lower exports of crude oil, which makes up more than 90% of Nigeria's export income.

However, there are modest signs of improvement.

For example, the commencement of operations at the Dangote Refinery. This facility, built by Africa's richest man, Aliko Dangote, boasts a capacity of 650,000 barrels per day and is expected to significantly cut down Nigeria’s dependence on imported refined petroleum products.

Main industries

The primary industries in Africa are largely centered around commodities - in most countries over 60% of total exports are commodities.

This creates a heavy reliance on fluctuations in global commodity prices which poses a significant risk. Therefore, there’s been a growing emphasis on economic diversification.

However, there's a growing emphasis on economic diversification.

🌾 Agriculture contributes 15-20% to the continent's GDP, but employs around 60% of the continent’s population. Leading products include coffee, cocoa, tea, cotton and tobacco.

🏭 Industry sector (manufacturing of goods, construction, and mining) contributing about 20 - 25% to GDP. Products include oil, gas, minerals and metals.

💼 Services sector (banking, telecommunications, tourism, and other business services) is the largest sector contributing around 60% to GDP.

💡 Spotlight: Africa’s growing renewable energy sector - could Africa supply Europe with green hydrogen?

The Sub-Saharan African renewable energy market is showing significant growth and potential, driven by the development of solar, wind, and hydroelectric projects.

Africa, particularly its northern and southwestern regions, could also be highly competitive in supplying green hydrogen for both local and global consumption.

Green hydrogen, produced using renewable electricity, is seen as crucial for achieving net zero, especially in hard-to-abate sectors.

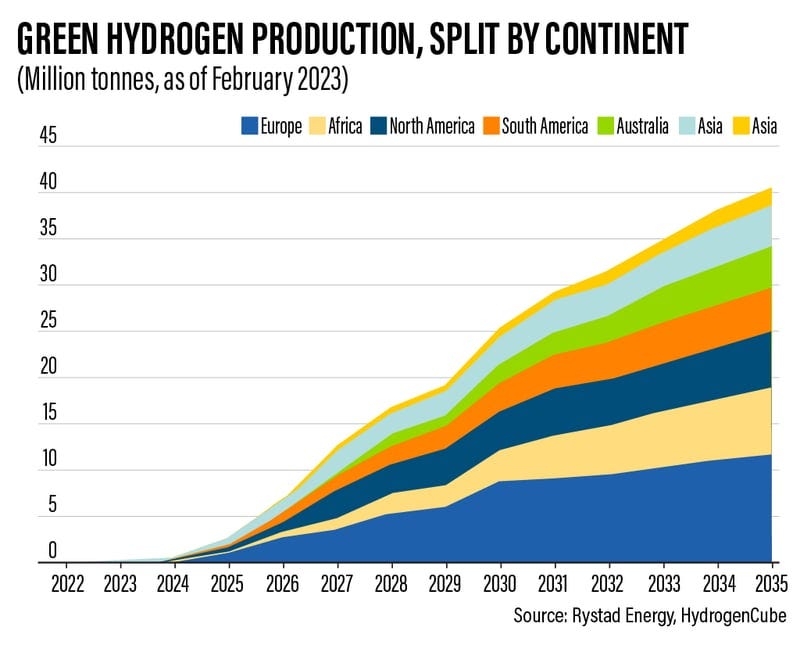

More than 52 green hydrogen projects have been announced in Africa, with production expected to reach 7.2 million tonnes by the end of 2035. Most of these projects will produce ammonia to be exported to Europe.

Germany, for instance, aims to import up to 70% of its hydrogen needs by 2030, with a significant portion expected to come from Africa. There are already initial agreements in place with African countries like Namibia to source green ammonia.

The key challenge is the infrastructure needed for large-scale production and transportation, whether through pipelines or by shipping in the form of liquid hydrogen or ammonia.

Strategic considerations for Investors

Africa's vast, diverse landscape offers opportunities for investments, but requires a nuanced, Pan-African strategy that acknowledges the different economic and political climates.

Investors should note the promising growth in several African countries - outperforming past economic hubs - such as Ivory Coast, DRC, and Ethiopia.

The continent's role as a potential green hydrogen supplier to Europe underscores the emerging sustainable investment sector.

Additionally, the boom in tech and services across Kenya, South Africa, and Nigeria offers avenues for digital and service-oriented investments.

Yet, the economic volatility that we observed e.g., 2023 in Nigeria underscores the imperative for robust risk management strategies, particularly for currency and inflation concerns.

Sources to learn more:

Green energy in Africa presents significant investment opportunities by McKinsey & Company, 2023

Datamapper, World Economic Outlook Oct 2023 by the IMF

South Africa Set to Topple Nigeria to Regain Mantle as Continent’s Biggest Economy, 2023, Bloomberg

Country Deep Dives, African Development Bank

Africa could be a key green hydrogen supplier to Europe amid energy crisis, Rystad says, 2023, The National News

Economic Development in Africa Report 2022, by UNCTAD

Enjoying out content?

Don’t keep it for yourself and share!

Subscribe to not miss future updates!

Feedback or thoughts?

Please let us know! Just reply to this e-mail. We’re happy to hear from you!

Thanks for reading,

Carolin

Disclaimer: All information provided is not intended to serve as investment advice. Any mention of industries or countries should not be taken as an endorsement.