Made in Africa: Leapfrogging to low-carbon industrialization in sub-Saharan Africa

Context and Investment Insights - Exploring 9 Priority Areas for Climate Action

Hi all,

Industrialization in most sub-Saharan African countries is in its early stages, yet there's undeniable momentum.

The value of local production hit once more home for me during a recent stay in Rwanda. While trying to buy a shower head (a story for another day 😉), I was struck by its high cost. The combination of imports and steep logistics costs drives prices up for all kinds of things from coffee machines to cars.

The silver lining, if you’re searching for one: Many sub-Saharan African countries, with little existing manufacturing infrastructure, have a unique opportunity. They can potentially leap directly to low-carbon industries, even if there’s a long road ahead.

So, this week, let’s delve into:

#5: Low-emission, resource-efficient industrialization

🕐 In a Hurry? Here's a 1-Minute Summary:

Sub-Saharan Africa's manufacturing accounts for only around 15% of its GDP, with agriculture and low-value services dominating, except in South Africa.

With its renewable resources, the region has a unique chance to leapfrog traditional development, diving directly into low-carbon industrialization.

Challenges like infrastructure deficits, lacking skills, financial barriers, and difficult business environments pose considerable hurdles.

But, positive developments are evident, and the EU, China, and various African nations are steering investments towards green sectors, backed by encouraging policies and skill-building initiatives.

Estimates identify a $2 trillion investment opportunity until 2050, primarily in the power sector to power low-carbon industry opportunities. Promising manufacturing areas are e.g., in sustainable textiles, building materials.

⏳ Ready for a Deeper Dive? Here's the Breakdown:

Context: Key facts and figures

(1) Industry and manufacturing plays minor role in most sub-Saharan African economies

Sub-Saharan Africa’s manufacturing footprint, accounts only for around 15% of its GDP, which emphasizes the continued importance of agriculture and basic services.

The region's primary exports revolve around natural resources and commodities, such as petroleum, copper, coffee, and cotton.

Its global manufacturing output remains negligible at less than 2%, however bright spots emerge.

Notably, South Africa, along with several northern African nations, has made significant strides in industrialization. Senegal, Ghana, and Benin have emerged as recent top performers in this regard.

Especially in specific manufacturing sectors, including food and beverage processing, textiles and apparel, as well as chemicals and plastics growth is visible.

Moreover, Chinese firms are making noteworthy investments, underscoring their confidence in the region's potential.

(2) Sub-Saharan Africa has the opportunity to “leapfrog” to low-carbon industrialization, skipping less efficient and polluting development

Ironically, a low level of industrialization may be an advantage when it comes to the low-carbon industrialization of the future.

“There’s a huge opportunity to build green and adopt new technology that could help Africa transition to higher-value production without inflicting the kind of environmental damage we’ve seen from manufacturing in the past” - Susan Lund, IFC’s vice president for economics and private sector development

While many highly developed, industrial nations grapple with retrofitting outdated fossil fuel infrastructure, many African nations possess a clean slate.

Africa's reserves of renewable energy sources, from solar, wind, and hydro to geothermal, present an opportunity to realize low-carbon industrialization from the beginning.

International organizations, governments, and NGOs are actively promoting green infrastructure developments in developing countries. African countries can tap into these resources to boost their green industrialization efforts.

Investing into green industries isn’t just an environmental gesture; it’s a pivot toward sustainable growth.

Job Creation: Green investments in Sub-Saharan Africa can generate many jobs, from R&D to manufacturing and maintenance.

Import Reduction: Higher domestic production reduces import reliance, shielding against global economic shifts and fluctuations in commodity prices.

Economic Growth: Diversifying into clean-energy-powered sectors like manufacturing, away from mining or agriculture, boosts growth.

Foreign Investments: Low-carbon infrastructure attracts multinationals targeting net-zero compliance.

(3) However, numerous challenges must be overcome

🛣️ Infrastructure: In many sub-Saharan African nations, issues like power outages, substandard roads, and limited port access hinder large-scale industrial development.

🎓 Skill Gap: There's often a mismatch in skills, due partly to education systems not aligning with industry needs and limited access to training.

💰 Finance: Limited access to finance and credit poses challenges for businesses. Even green investments face higher capital costs in Africa compared to other regions.

🚧 Trade Barriers: Despite initiatives like the African Continental Free Trade Area, seamless intra-Africa trade remains a distant goal.

📜 Business Environment: High costs of doing business in several countries arise from non-transparent and unreliable regulations and administrative processes.

(4) Signs of Positive Developments

Finance

The European Union, China, and other major global players have shown interest in investing in green infrastructure in Africa. The EU committed to investing 150 billion EUR by 2030.

In general, FDI investments are shifting from extractives to sectors like renewables, advanced manufacturing, and automotive.

Several African countries, like Nigeria and Kenya, have issued green bonds, which are aimed at financing sustainable projects, including renewable energy and climate resilience projects.

Policies

A number of sub-Saharan African countries have developed national green industrial policies such as e.g., Ethiopia’s Climate Resilient Green Economy Strategy, or South Africa’s Integrated Resource Plan.

The policy framework of the African Continental Free Trade Area can also significantly boost green industrialization by encouraging the trade of green goods and services across the continent

Skills and Training Initiatives

There have been increased efforts to build local expertise in green technologies. For instance, the African Solar Industry Association has been involved in various capacity-building initiatives.

Investment insights

(1) Market: Early stage, gaining traction

McKinsey estimates, it would require $2 trillion in investments until 2050 to decarbonize the continent’s manufacturing and power sector.

Around $600 million are required to decarbonize existing manufacturing industries and power networks, and $1.4 trillion to develop new, low-emitting substitution businesses

The good news: There’s plenty of investment opportunities in green manufacturing.

McKinsey identified 8 opportunities that alone have the potential to provide revenues between $200 million and $2 billion per year and create about 700,000 jobs by 2030 in Africa.

(2) 5 Investment Areas We’re Excited About

Green industrialization offers plenty of opportunities for African SMEs to grow.

Sustainable Textile & Fashion: Companies specializing in the cultivation and processing of organic cotton, which uses fewer pesticides and chemicals. SMEs using natural or low-impact dyes and sustainable processes to reduce pollution and water usage.

Green Building Materials: Companies producing sustainable construction materials, like bamboo, compressed earth blocks, or recycled metal and glass. Also manufacturing insulation materials from sustainable or recycled sources to promote energy efficiency in buildings.

Renewable Energy Equipment: Local assemblers or manufacturers of solar panels, wind turbines, or components. Producers of efficient cookstoves or biomass briquettes.

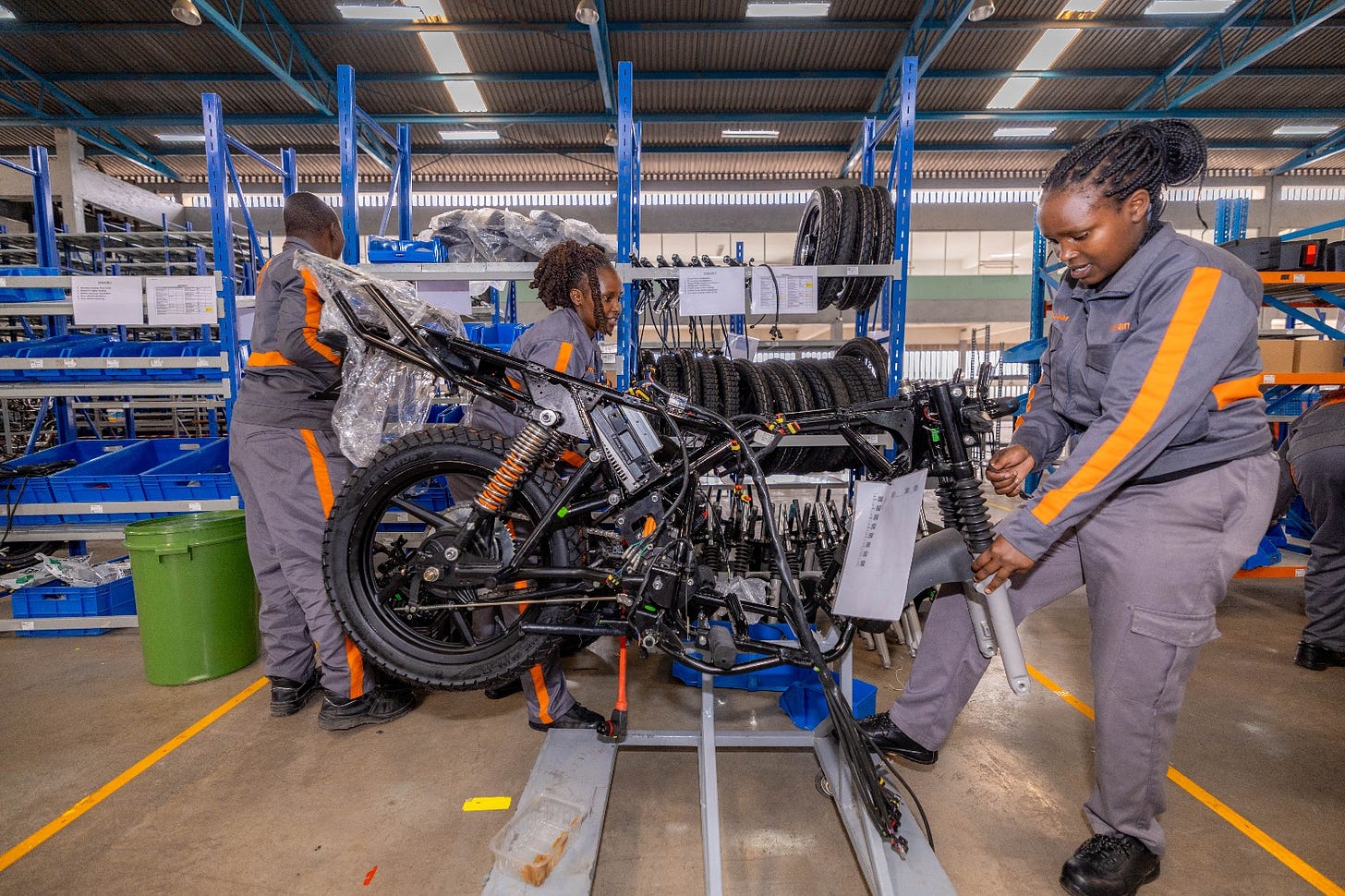

Sustainable Automotive & Transportation: Local assemblers or manufacturers of parts for electric vehicles, especially two-wheelers or three-wheelers. Producers of battery storage solutions or charging equipment for electric vehicles.

Digital & Tech Solutions for Green Manufacturing: Firms developing software or sensors for optimizing energy use in factories, reducing waste, or streamlining supply chains for sustainability.

(3) Investors Leading the Way - Selected examples

African Infrastructure Investment Managers: An infrastructure-focused private equity fund that invests in African infrastructure, including those related to sustainability.

AfricInvest: A Tunisia-based private equity firm focused on mid-cap companies.

Multinational Corporates such as e.g., Siemens and General Electric that invest directly in industrial projects in Africa

Development Finance Institutions such as the International Finance Corporation (part of the World Bank) and the African Development Bank

Sources to learn more:

Industrial Development Report 2022, United Nations Industrial Development Organization

Africa’s green manufacturing crossroads, McKinsey & Company, 2021

Manufacturing Africa’s future: Jobs, growth, and sustainability, McKinsey & Company Podcast, 2023

Africa Industrialization Index, African Development Bank, 2022

Manufacturing, ISS African Futures

Industrialising Africa: Renewed commitment towards an Inclusive and Sustainable Industrialization and Economic Diversification, African Union, 2022

Enjoying out content?

Don’t keep it for yourself and share!

Subscribe to not miss future updates!

Feedback or thoughts?

Please let us know! Just reply to this e-mail. We’re happy to hear from you!

Thanks for reading,

Carolin

Disclaimer: All information provided is not intended to serve as investment advice. Any mention of industries or countries should not be taken as an endorsement.