Renewable Riches: Introduction to Energy & Infrastructure in Africa

Context and Investment Insights - Exploring 9 Priority Areas for Climate Action

Dear all,

When I learned that Africa holds just 2% of the world's renewable energy capacity, I was surprised. With its abundant solar, hydro, wind, and geothermal resources, this seemed counterintuitive.

However, as is frequently the case, financing presents a challenge. On the flip side, this also means that investors have the potential to make a substantial impact.

Access to clean energy carries significant implications for sustainable development. Join me this week as we delve into our crucial third topic:

#3: Climate-Resilient and Low-Emission Energy & Infrastructure

🕐 In a Hurry? Here's a 1-Minute Summary:

Africa's Energy Challenge: Despite low energy consumption and vast resources, renewables contribute only 10% of primary energy and 23% of electricity in Africa. Installed capacity is negligible compared to other regions. The IEA's Sustainable Africa Scenario (SAS) foresees to address this by adding 260 GW of renewable capacity by 2030.

Green Hydrogen Potential: Abundant solar resources in Africa make it a prime location for green hydrogen production, representing a significant EUR 1-trillion opportunity and a potential 40% reduction in African emissions. 3 major hubs have been identified to serve the African continent and to export.

Positive Impacts of Clean Energy: Transitioning to clean energy in Africa has the potential to boost GDP, enhance well-being, improve energy access, create jobs, and protect the environment.

Investment Requirements: Meeting energy and climate goals necessitates doubling investments from today’s USD 90 billion by 2030, with a focus on clean energy. This requires scaling financing, engaging institutional investors, bond markets, concessional capital, and supportive policies to attract private investment in renewable projects.

SME Investment Opportunities: SMEs in Africa's clean energy sector present promising investment prospects. Interesting areas include solar solutions, energy efficiency services, biogas/biomass initiatives, mini-hydro projects, and energy-related software and analytics for effective energy management and reduction.

⏳ Ready for a Deeper Dive? Here's the Breakdown:

Context: Key facts and figures

(1) Africa's Energy Gap: Renewable energy capacity remains small, despite vast resources

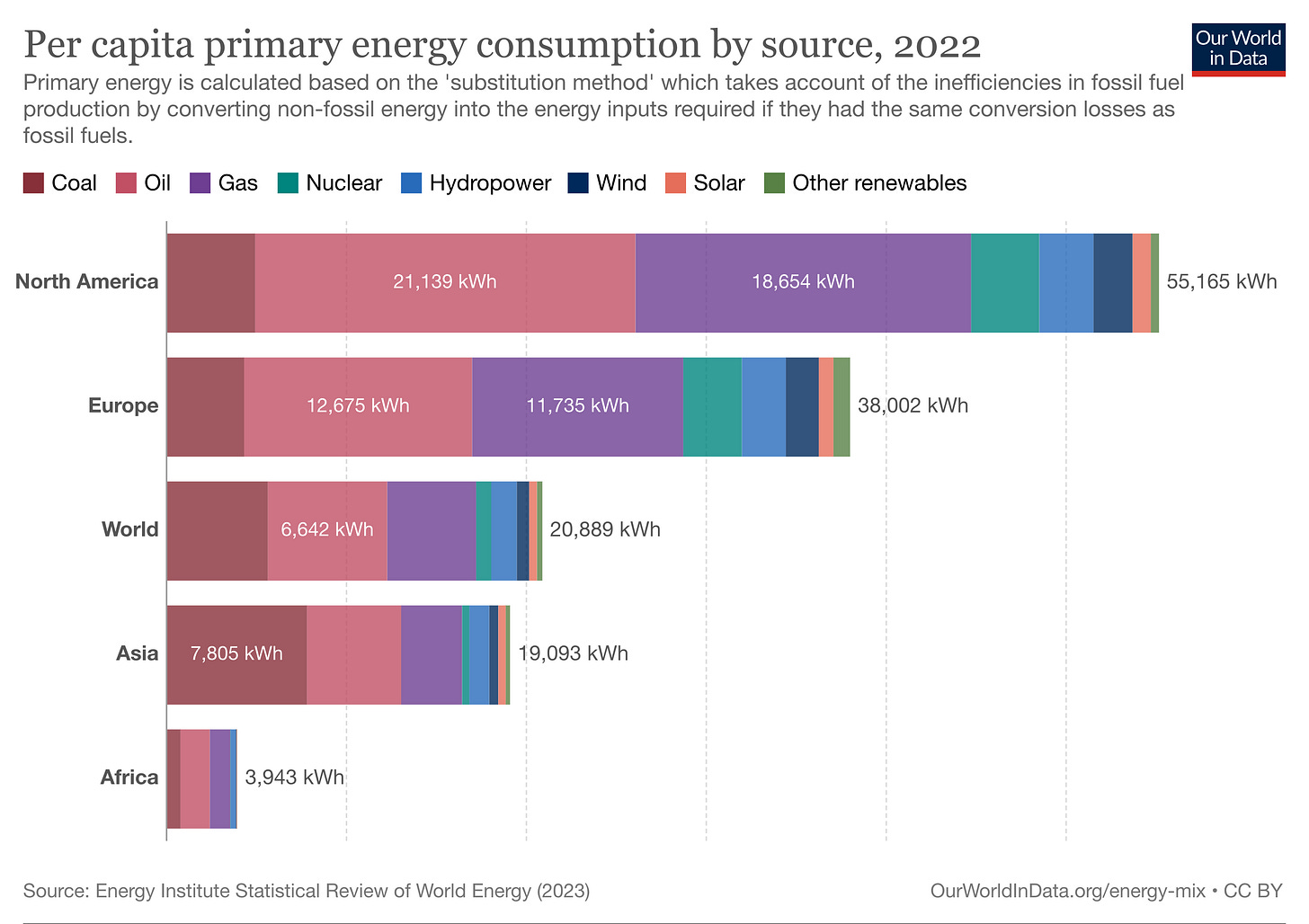

Africa's energy consumption is significantly lower than in other regions, totaling less than 6,000 TWh. This results in a per capita energy consumption of just 4,000 kWh in Africa, significantly below the global average of 21,000 kWh and only about 10% of Europe's per capita consumption.

Widespread energy access remains a pressing issue, with 43% of Africans lacking electricity access and 70% lacking clean cooking facilities.

In 2022, renewable energy sources contributed 10% of Africa's primary energy and 23% of its electricity. Notable exceptions exist in countries like the DRC, Namibia, Ethiopia, and Kenya, where over 90% of electricity is derived from low-carbon sources.

Hydropower dominates this landscape, constituting 75% of Africa's renewable electricity production, followed by wind and solar.

However, overall installed renewable energy generation capacity remains modest, despite Africa being home to approximately 20% of the world's population:

💧 Hydropower capacity in Africa stands at 39 GW, representing a mere 2.9% of global capacity.

🌬️ Wind power capacity totals 8 GW, accounting for less than 1% of worldwide capacity.

☀️ Solar power capacity reaches 13 GW, equivalent to 1.2% of global capacity.

(2) A clean energy pathway: The IEA’s Sustainable Africa Scenario

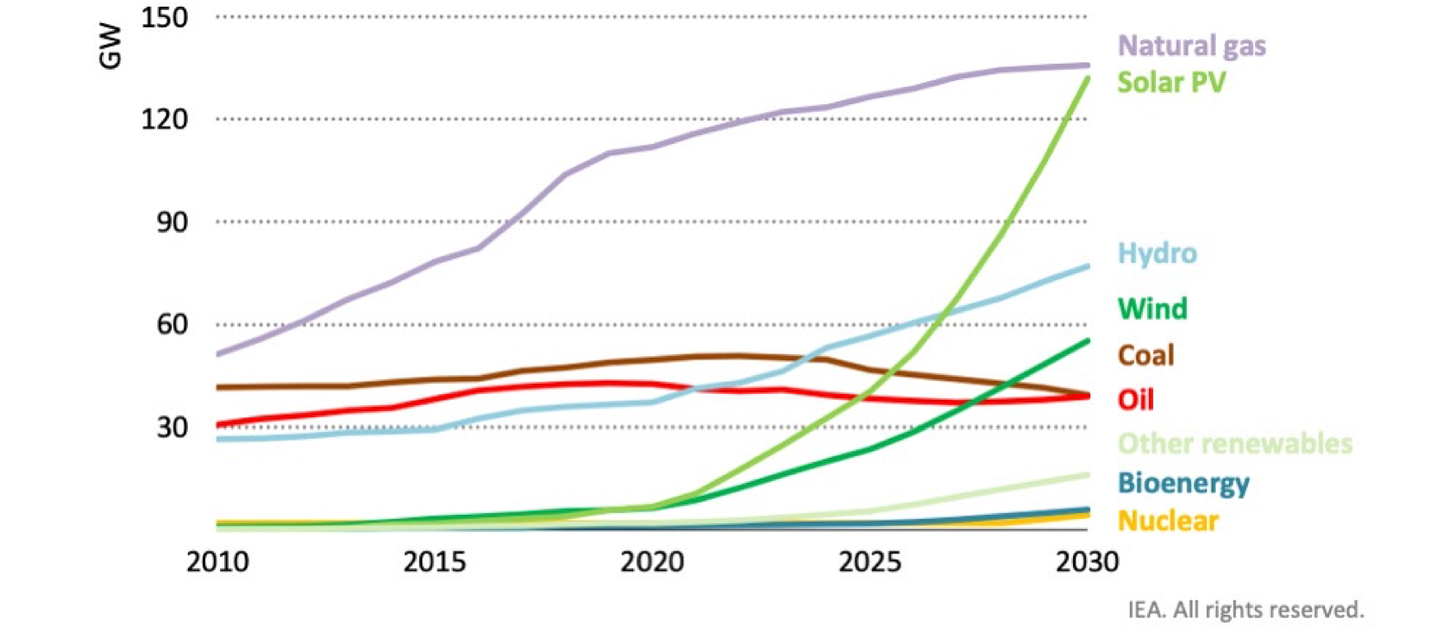

The IEA's Sustainable Africa Scenario (SAS) envisions Africa achieving its energy-related goals by 2030 primarily through renewables. This includes adding 260 GW of solar, wind, hydro, and geothermal capacity. The SAS promotes solar PV-powered mini-grids and standalone systems in rural areas for electricity access.

Under this scenario, the IEA foresees Africa halting the construction of new coal-fired power plants, redirecting investments toward solar PV. Expanding national grids is seen as the most cost-effective means for nearly 45% of those gaining electricity access by 2030.

The report emphasizes that top-tier solar PV and wind projects are already cost-competitive with new gas and coal plants in most African regions and could become even more competitive by 2030.

In the IEA's Sustainable Africa Scenario, solar, hydro, and wind power generation capacities are projected to surpass those of coal and oil by 2030 (graph below).

(3) The potential of Green Hydrogen - a 1-trillion EUR opportunity

Green hydrogen plays a vital role in decarbonizing industries such as fertilizer, steel, and refineries, crucial for addressing climate change. Africa, with its abundant renewable energy resources, particularly solar, is an ideal location for green hydrogen production.

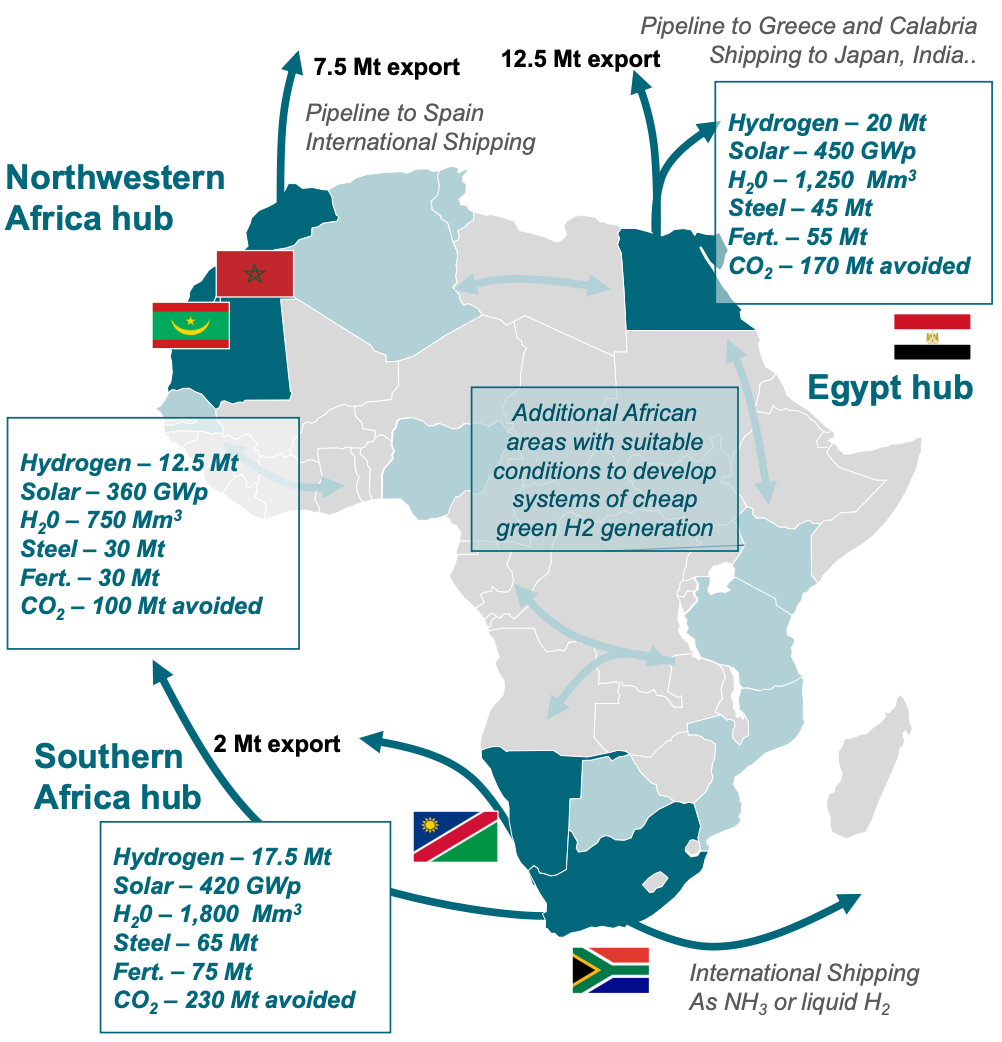

The study 'Africa's Extraordinary Green Hydrogen Potential' highlights three solar-powered hubs: Northwest (Mauritania, Morocco), South (South Africa, Namibia), and Egypt.

By 2030, solar-driven green hydrogen is expected to cost less than EUR 2/kg, becoming competitive with fossil fuel energy at EUR 90/barrel. This shift promotes low-carbon growth, potentially reducing emissions by 40% across Africa.

The study envisions Africa producing 50 million tons of green hydrogen annually by 2035, with export potential of 25 million tons, equivalent to 15% of the EU's gas consumption.

Selected key projects include:

Mauritania's Aman Project: Largest in Africa, 1.7 million tons/annum, powered by 30 GW solar/wind, costs $40 billion (CWP Global).

Namibia's Tsau Khaeb Project: 3 GW, $9.4 billion, 300,000 tons/annum (HYPHEN Hydrogen Energy).

South Africa's Green Ammonia Plant: 780,000 tons/annum, $4.6 billion (Hive Hydrogen), HySHiFT project, €15 million subsidy from Germany.

(4) Positive Impacts of Clean Energy

According to a report by IRENA outlining their strategy for transitioning to cleaner energy, known as the 1.5°C Scenario, Africa stands to benefit substantially.

By following this plan until 2050, Africa's GDP is expected to increase by 6.4%, while the overall well-being index could see a remarkable improvement of 25.4%.

The transition to clean energy offers additional advantages:

🌟 Enhanced Energy Access: Widespread adoption of clean energy will facilitate better access to technology, online learning opportunities, and improved lighting. It will also promote the use of clean cooking technologies, which directly contribute to improved public health.

🛠️ Job Creation: The transition is expected to create more jobs than are those lost in traditional energy sectors. Investing in renewables between 2020 and 2050 is estimated to generate a minimum of 26 job-years for every million dollars invested. Energy efficiency investments are projected to yield at least 22 job-years per million dollars annually, while energy flexibility investments would result in 18 job-years for every million dollars spent per year.

🌿 Environmental Benefits: The transition to clean energy will play a crucial role in safeguarding biodiversity and protecting the environment.

(5) Investment Requirements

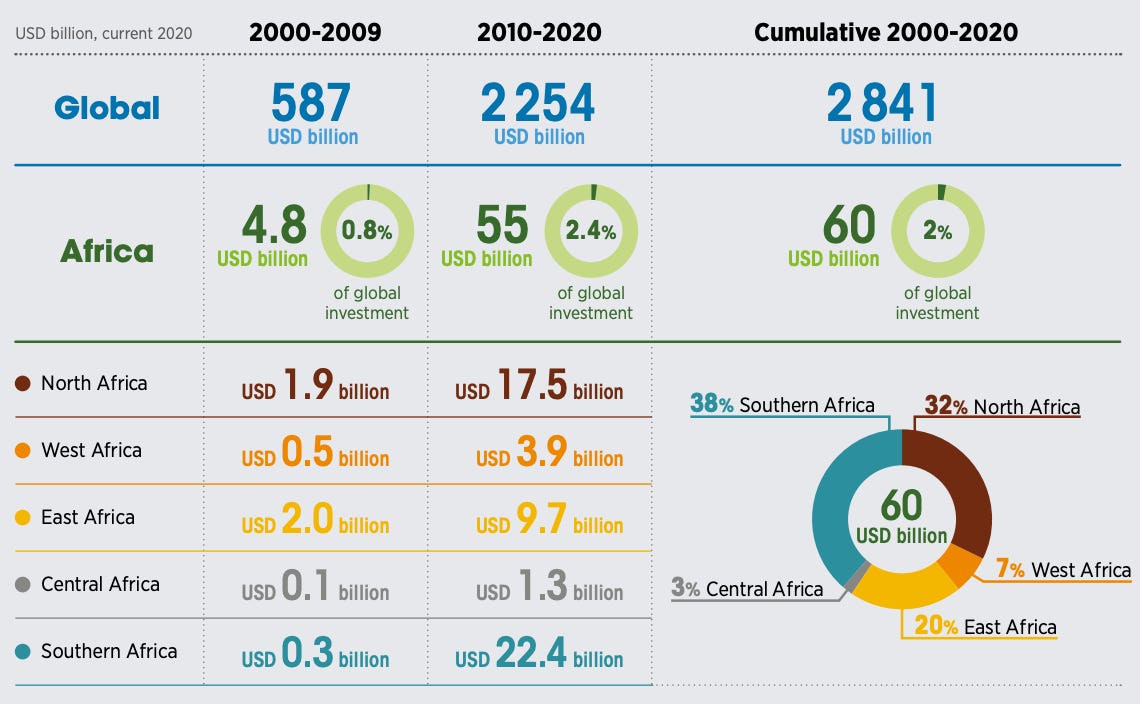

Africa attracts only 2% of global clean energy investments.

To meet energy and climate goals in Africa, investment must more than double from today’s USD 90 billion by 2030, with a focus on clean energy.

“The African continent has huge clean energy potential, including a massive amount of high-quality renewable resources. But the difficult backdrop for financing means many transformative projects can’t get off the ground” - IEA Executive Director Fatih Birol

Scaling financing for Africa's energy future is vital. Concessional capital is crucial to catalyze private investment. About USD 28 billion annually in concessional funds is needed to unlock USD 90 billion in private sector investments by 2030, a tenfold increase. Local financing, from commercial banks and institutional investors, mitigates currency and pricing risks due to their familiarity with local markets.

Investment insights

(1) Market: Huge opportunity, challenging to access

Opportunity: Africa boasts vast untapped renewable energy potential, offering an exciting investment prospect. Renewable projects, expected to drive 80% of capacity growth this decade, attract investors seeking financial returns and sustainable development.

The scale of this opportunity is significant, with the IEA estimating a need for over $200 billion annually by 2030 to realize their Sustainable Africa Scenario.

Challenge: Bridging the capital gap is a persistent issue. Inadequate early-stage and equity financing for feasibility studies and project development leaves investors frustrated by the shortage of bankable projects.

Securing affordable debt funding for construction and operation phases is equally challenging. Clean energy projects in Africa face capital costs 2-3 times higher than advanced economies. This elevated cost renders many projects economically unviable, including small-scale initiatives relying on local banks, primarily due to stringent collateral requirements.

Facilitating Private Investment: To attract private investors, projects often receive support through guarantees and risk-sharing with development finance organizations.

Proactive governments bolster investor confidence through policies such as feed-in tariffs, power purchase agreements, and tax incentives, fostering an environment conducive to renewable energy investment.

(2) 5 Investment Areas We’re Excited About

Solar Energy Solutions: Companies developing and installing small to medium-scale solar energy systems. This includes rooftop solar panels for businesses and residential areas, as well as solar-powered mini-grids for remote communities.

Energy Efficiency Services: Companies offering energy efficiency services to businesses to help them reduce their energy consumption and operational costs through energy audits, retrofitting, and the implementation of energy-efficient technologies.

Biogas and Biomass: Companies exploring the potential of biogas and biomass energy production. This includes setting up biogas digesters on farms, which can convert organic waste into biogas for cooking and electricity generation.

Mini-Hydro Projects: Small-scale hydroelectric power projects. SMEs that develop mini-hydro installations to generate electricity for local communities or businesses.

Energy-Related Software and Analytics: Companies developing software and analytics tools for energy management, monitoring, and optimization that help businesses and industries track and reduce their energy consumption.

(3) Investors Leading the Way - Selected examples

SunFunder: Blended debt financing of solar energy projects

Gaia Impact Fund: VC firm focused on renewable energy.

Beyond the Grid Fund for Africa: Programme bringing clean and affordable off-grid energy to Sub-Saharan Africa

An up-to-date overview of 140+ financing instruments for decentralized renewable energy ventures is maintained by GET.Invest and can be accessed here.

Sources to learn more:

Africa Energy Outlook 2022, IEA, 2022

Renewable Energy Market Analysis: Africa and its Regions, IRENA, 2022

State of African Energy Q2 2023 Outlook, Africa Energy Chamber

Financing Clean Energy in Africa, IEA, 2023

Enjoying out content?

Don’t keep it for yourself and share!

Subscribe to not miss future updates!

Feedback or thoughts?

Please let us know! Just reply to this e-mail. We’re happy to hear from you!

Thanks for reading,

Carolin

Disclaimer: All information provided is not intended to serve as investment advice. Any mention of industries or countries should not be taken as an endorsement.