Understanding Africa's Continental Free Trade Area (AfCFTA)

Progress and Development Impact

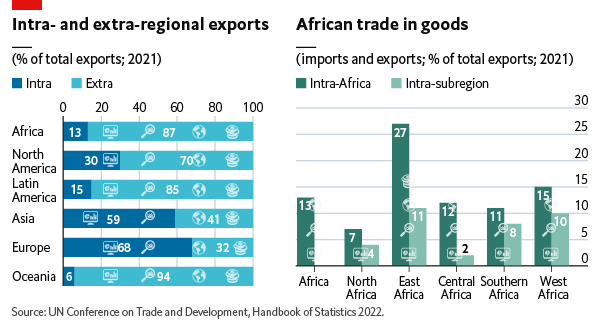

More than 85% of African countries’ exports are leaving the African continent

While Europe and Asia boast intra-regional export rates exceeding 50%, Africa predominantly engages in trade with other world regions (especially Europe and Asia).

Limited intra-African trade presents several challenges and missed opportunities for the continent

🌍 Economic Dependence: Relying heavily on external trade exposes Africa to global economic fluctuations. Intra-African trade offers a stable and diverse economic foundation.

🤝 Regional Integration: Intra-African trade strengthens regional unity, enhancing stability and cooperation.

💰 Trade Cost Reduction: Intra-regional trade costs less due to lower tariffs and barriers. Removing these in Africa boosts competitiveness.

🔧 Technological Transfer: Intra-African trade fosters tech, knowledge, and innovation exchange, boosting productivity.

👥 Job Creation: Intra-African trade creates jobs, fights unemployment, and reduces poverty. Low trade leads to raw material reliance, hindering local industries. More trade drives industrialization through production within the continent.

AfCFTA is a trade agreement among African Union members

What is the AfCFTA?

🌍 It will be the world’s largest free trade area (by number of countries), uniting almost 1.3 billion people, and creating a combined GDP of around $3.4 trillion.

🚀 The AfCFTA aims to create a single market for goods and services, facilitate the movement of people, promote investment, and foster economic integration across the African continent.

📅 The AfCFTA was officially launched on January 1, 2021, after years of negotiations.

What is the current status of implementation?

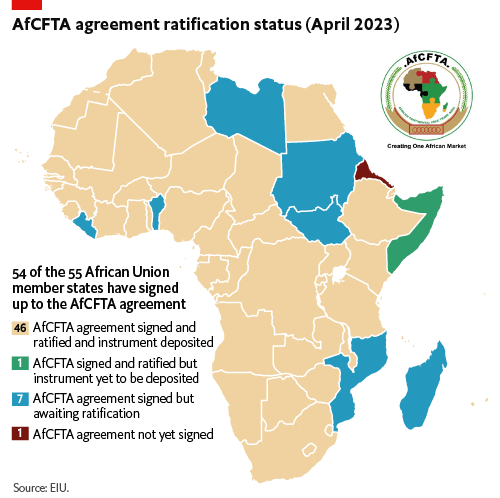

47 countries have ratified the AfCFTA agreement, and efforts continue to increase participation. Key achievements include the endorsement of protocols for market function, investment policy, intellectual property rights, and competition policy.

However, despite progress, only about 100 out of 4,500 listed products (90% tariff headings) are currently being traded under the AfCFTA.

What are the predicted economic benefits of the AfCFTA?

💡 The World Bank estimates real income gains of 8% ($560 billion) by 2035 due to AfCFTA implementation, varying across countries, with Côte d'Ivoire and Zimbabwe seeing income gains of 14%, while others at around 2%.

📈 Furthermore, there is an expected increase in the volume of total exports by almost 29%, with intra-African exports anticipated to surge by over 81%.

Industries that are set to gain the most from the AfCFTA are:

🌾 Agro-Processing: AfCFTA aims to enhance production and trade in agro-processing, leading to job creation, reduced import costs, and increased domestic value addition.

🚗 Automotive: The AfCFTA could stimulate the growth of local and regional automotive industries, benefiting from economies of scale, improved trading conditions, and the potential for assembly, production, and sourcing partnerships.

💊 Pharmaceuticals: The pharmaceutical sector could flourish under the AfCFTA, offering opportunities to meet local demand, create value chains, and encourage partnerships between international and local companies, contingent on reduced tariffs and regulatory harmonization.

🚚 Transport and Logistics: The AfCFTA's focus on developing intra-African trade could lead to significant growth in transport and logistics services, necessitating infrastructure upgrades and attracting construction companies, transport providers, and related supply chains.

💰 Financial Services: Financial services providers are poised to expand operations across the continent with negotiations to reduce services-related barriers, leveraging the nimbleness of the sector and targeting underserved urban populations.

📱 Telecommunications: Improved cross-border operations and scaling opportunities could boost telecommunications services, driven by partnerships and investments from both local and international sources.

✈️ Travel, Tourism, and Hospitality: Enhanced connectivity between African states and the implementation of open skies initiatives could drive growth in travel, tourism, and hospitality sectors, benefiting from increased intra-African movement and investment opportunities.